More Tea Suh? 7 Black Congressional Ho-Reps Voted for Law to Enrich Banks & Eliminate Discrimination Reporting Requirements

/The Moteasuh Tribe are sorry ass coin-operated kneegrows who pander to Massah's agenda. [MORE] Quite a disguise, pretending to represent Black folk. How will Doggy reward these coin operated dummies? Read on for details. In other areas of people activity SNiggers such as Deidrie Henry, who degrades Black people as "Popeyes Annie" in service of RSW, are now millionaires.

From [HERE] and [HERE] On Tuesday the Republican-controlled U.S. House of Representatives voted to roll back financial regulations put in place following the 2008 financial crisis. 33 Democrats captive to big banks’ political donations helped. They delivered a huge gift to Wall Street banks on the very same day they reported record-shattering profits.

As the Los Angeles Times’ David Dayen explained, the bill — named the “Economic Growth, Regulatory Relief, and Consumer Protection Act,” or, more simply, S.2155 — would roll back numerous consumer protections the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) put in place after various big banks failed a decade ago, requiring bailouts from taxpayers to keep them afloat.

The vote comes just months after an International Monetary Fund economist published a study showing that nearly every major financial collapse in both Europe and the United States, dating back to the 18th century, came after governments loosened regulations on the financial sector. The includes devastating financial meltdowns like the Panic of 1825 in Great Britain, all the way up to the subprime mortgage bubble’s burst in the late 2000s in the U.S.

Republicans’ typical argument against regulations on businesses is that it cripples their ability to make a profit. However, according to data from the Federal Deposit Insurance Company (FDIC), banks are making record profits even with the current regulations in place. Banks made a quarterly net income of $56 billion in the first quarter of 2018, outpacing the last record of $48.1 billion set in the second quarter of 2017:

Among some of the provisions of the bill include lowering the amount of reserves banks need to keep on hand in the event of a financial crisis and resulting withdrawals of assets from panicking customers, protections put in place to cut down on banks discriminating against customers applying for mortgages, and allowing banks to recategorize roughly $3.8 trillion in municipal bonds as “highly liquid assets,” while repealing several other important financial protections.

The bill loosens reporting requirements used to counter racial discrimination in lending practices. The NAACP and the Leadership Conference on Civil and Human Rights, opposed it because it excuses the majority of banks from adhering to anti-discrimination reporting requirements.

The legislation includes a number of technical changes that stand to put borrowers of color, mobile-home owners, and rural residents at risk. Chief among these is a change letting banks that make fewer than 500 mortgage loans a year report less data to the government on who they lend to and at what rates—data meant to help show whether financial institutions are discriminating against families of color. According to data from the Consumer Financial Protection Bureau, the legislation might exempt four out of every five banks and credit unions.

Ho-Reps On A New Low Level Like McNegro Kevin Hart

Supporters of the provision have argued that the vast majority of mortgage loans would still be covered by these reporting requirements, which stem from the 1975 Home Mortgage Disclosure Act (HMDA) and were expanded by Dodd-Frank, and also argued that the intention is to make things easier for small banks without the resources to handle the data reporting. An amendment made to the bill this week also required small banks that have gotten low scores on examinations performed by the government to provide the full scope of HMDA data.

But fair-lending groups, civil-rights organizations, and Democratic politicians have pointed out that many financial institutions would still be able to discriminate and hide their discrimination—and the government, journalists, and housing activists would have fewer tools to detect troublesome patterns. That might make it harder for regulators to identify discriminatory lending practices that might precipitate another crisis going forward, or simply make the country’s yawning racial wealth gap worse. “The only way to enforce fair-lending laws is to have an accurate picture of what the market looks like,” Scott Astrada, the director of federal advocacy for the Center for Responsible Lending, a policy-research group, told me. [MORE]

The bill also crucially shrank the amount of capital reserve banks must maintain and raised the threshold at which banks are required to comply with heightened risk-management regulations — all of it with the consequence of introducing more risk into the system.

Though touted as a bill narrowly tailored to benefit small and community banks, it also includes a provision that could allow banks, such as Citigroup and JP Morgan, to add more debt-fueled risk to their balance sheet, a change advocated by Citigroup’s lobbyists.

While it’s no surprise that Republicans — most of whom remained staunchly opposed to regulating big banks even in the immediate aftermath of the financial crisis — sponsored S.2155 and voted for it in both the Senate and the House, Democrats’ support of financial deregulation is surprising. However, the “yea” votes of those 33 House Democrats is less surprising when considering the amount of money they’ve received from big banks over the course of their careers.

Above are the 33 Democrats who voted with every Republican but one—Rep. Walter Jones (N.C.)—to reward big banks on the ten-year anniversary of the 2008 Wall Street collapse. The Black Ho-reps who supported the law are

- Rep. Sanford Bishop (GA). Donations from commercial banks: $295,150 (since 1998)

- Rep. David Scott (GA). Donations from commercial banks: $560,701 (since 2001)

- Rep Andre Carson (Ind),

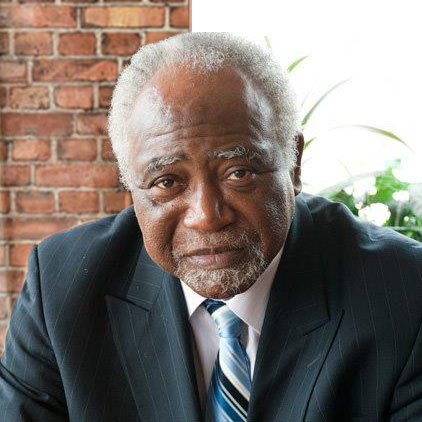

- Rep Danny Davis (Ill),

- Rep. Al Lawson (Fla),

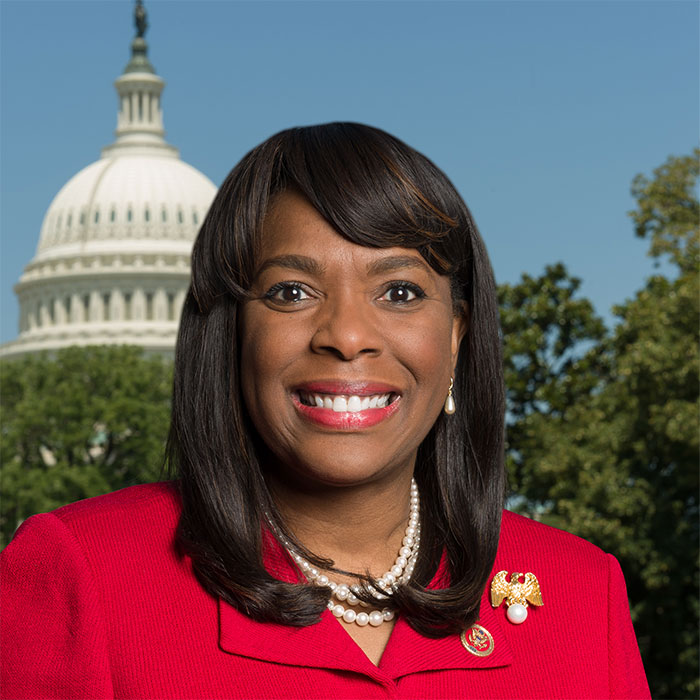

- Rep Terri Sewell (Ala). Donations from commercial banks: $315,400 (since 2009)

- Rep Alcee Hastings (Fla).

"This bill will enrich banking giants like Citigroup and JPMorgan Chase that are already enjoying record profits. Meanwhile, it will make it harder for black and brown people to become homeowners, and will increase the chances of another taxpayer bailout," Rep. Keith Ellison, who voted against the bill and denounced it forcefully on the House floor, wrote after the bill passed. "Disgraceful."

In a strong indication that they are well aware of how politically toxic a vote to reward big banks is in the eyes of the American public, not a single one of the 33 Democrats who voted for the bill—many of whom have received substantial sums of campaign cash from big banks—had the courage to speak in favor of it on the House floor.